Financial Industry and Financial Markets

Even compared to other market rollercoasters, the one we've been on over the last week has been extreme. We've seen some of the biggest intra-week swings in 25 years, with few investors having a clear idea of what will happen next in the unfolding global trade war.

I'll discuss all the twists and turns below and then explore where all this nervy capital is likely to flee.

Today's Market Minute

* Global shares surged and a manic bond selloff stabilised on Thursday after U.S. President Donald Trump said he would temporarily lower the hefty duties he had just imposed on dozens of countries.

* The "Magnificent Seven" stocks amassed more than $1.5 trillion in market value on Wednesday after Trump's surprise announcement.

* Chinese companies that sell products on Amazon are preparing to hike prices for the U.S. or quit that market due to President Donald Trump's unprecedented tariff hikes, sellers and the head of China's largest e-commerce association said.

* Ray Dalio, founder of the world's largest hedge fund, called for a U.S. deal with the Chinese on tariffs.

* Wall Street bosses are girding for Europe to sideline American investment banks in response to the tariff war unleashed by U.S. President Donald Trump, fearing client boycotts and in a worst-case scenario, even formal restrictions.

Ninety more days of guesswork

The S&P 500 SPX staged a near 10% bounceback on Wednesday after President Donald Trump announced a 90-day pause in his sweeping "reciprocal" tariff hikes, while also intensifying pressure on Beijing by jacking up U.S. levies on Chinese goods to 125%.

China refused to be cowed and responded on Thursday by hiking tariffs on U.S. imports to 84%, along with additional restrictions on 18 U.S. companies.

Whatever happens with Trump's broader tariff push - and 10% universal tariffs remain despite the hiatus - the world's two biggest economies are in a full-blown trade war.

Wall Street's relief surge rippled across stock markets around the world overnight, with Japan's Nikkei NI225 almost matching the S&P 500 rally and European stocks (.STOXXE) rebounding about 5%. Even China's stocks rose 1-2%.

Now what?

Taking a step back from the wild volatility of the past 24 hours - and wild it was with the VIX 'fear index' VIX still near 40, almost twice historical averages - the S&P 500 remains down 4% since the April 2 tariff salvo, and 10-year U.S. Treasury yields are 10 basis points higher than a week ago. U.S. stock futures

ES1!,

NQ1!, (RTYc1) have also given back 2-3% of Wednesday's jump.

The dollar DXY remains slightly nonplussed in the middle of all that, with its main DXY index down about 2% since April 1. But the greenback is up 1% against China's offshore yuan

USDCNH over that period, as the People's Bank of China allowed the official rate to weaken for the sixth straight day to 19-month lows.

While the U.S.-China row deepens, other countries now have to consider how they will handle the pause. The European Commission said it would take the time to assess Trump's delay and consult member states.

But uncertainty over what will happen in three months' time will now cast a pall over the second quarter, with much corporate planning likely sidelined for longer. Meanwhile, full-year guidance from the looming first-quarter earnings season will kick in tomorrow.

Much of the speculation on Wednesday was that a sharp selloff in Treasuries this week was chiefly responsible for Trump blinking on wider tariffs.

While worries about China's potential withdrawal from Treasuries mounted, the 10-year note auction US10Y went better than feared on Wednesday. And 30-year bonds are going under the hammer later on Thursday.

The stock rally took almost one full Federal Reserve rate cut out of futures pricing for the remainder of the year. Fed minutes were also released from the most recent meeting. The tone was cautious, though these comments have clearly been overtaken by last week's events and Chair Jerome Powell's hawkish speech from last Friday.

U.S. March inflation numbers that are due for release later on Thursday will similarly be slightly out of date.

For today's deep dive, I'll look into just where frightened money is heading now that Treasuries' 'safe haven' qualities have been compromised.

Safe European home? Scared money seeks German bunds

At a scary moment when almost no place in global markets looks safe, Germany's recently rocky government bonds may be one of the few true havens left.

A week of precipitous global stock market losses driven by Washington's unfolding trade war took an alarming turn on Tuesday as offsetting safety bets in U.S. Treasury bonds turned sour too.

The wild and unpredictable ride continued late on Wednesday, when Trump blinked in his tariff campaign and paused the so-called 'reciprocal' import levies for 90 days for all except China, prompting a mind-blowing 8% in stocks.

Whatever happens next, the market playbook up to that point sets a jarring precedent for the inevitable next convulsion.

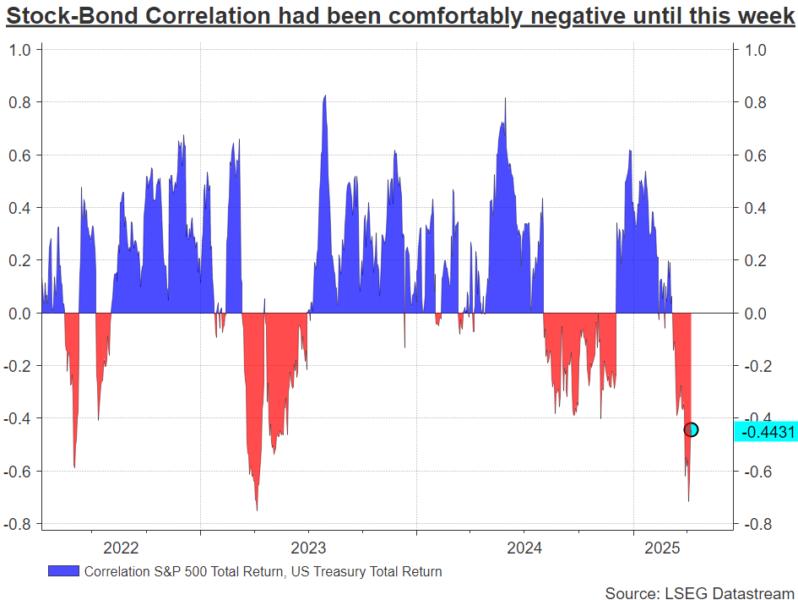

Treasuries had been behaving well again this year as a portfolio buffer, surging in value as equities tanked on tariff fears. Indeed, the correlation between the two asset classes actually hit its most negative in two years last week.

But that correlation flipped violently again this week.

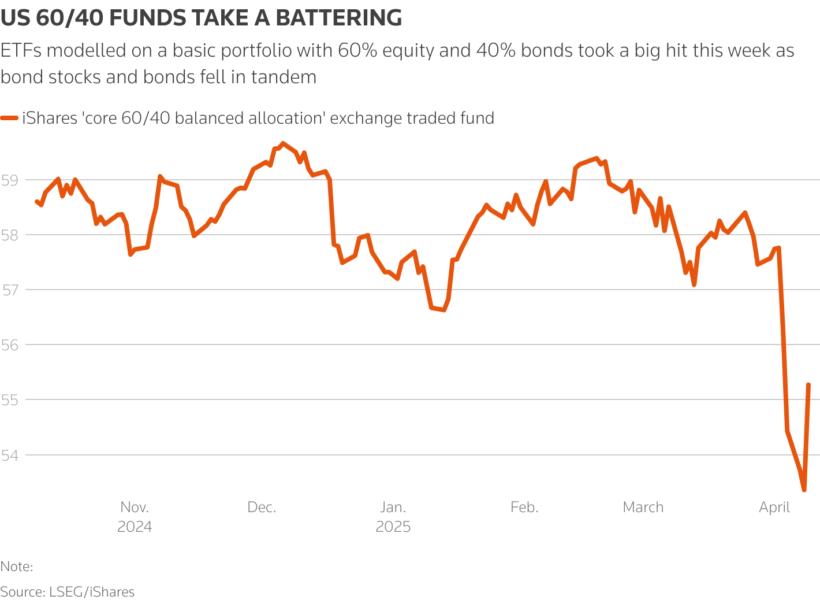

As an example of how that affects savings pots, exchange traded funds that track standard 60/40 equity/bond portfolios AOR, which had been fairly serene from November's election right through the turbulent first quarter, tanked 8% since the U.S. tariff plan was first laid out last Wednesday.

Indeed, U.S. Treasury ETFs GOVT and the S&P 500

SPX are down more than 2% each this week.

The twin stock/bond selloff seems to have had many triggers, including the escalating U.S.-China tariff battle, fears that traders' margin calls in risky bets were leading to liquidation of safe assets, and a perceived reluctance of the Federal Reserve to ease credit.

All may have been in play, but the burgeoning narrative now is that overseas investors are fleeing American assets at large due to the seemingly chaotic nature of Trump's trade war. With total U.S. investment liabilities to foreign savers standing at more than $62 trillion at the end of last year, that thought is alarming, to say the least.

Goldman Sachs currency strategist Michael Cahill said U.S. assets and the dollar were being hit by recessionary fears and high uncertainty about the endgame in the trade war as well as a growing worry about the stability of U.S. institutions.

"Negative trends in U.S. governance and institutions are eroding the appeal of U.S. assets for foreign investors," Cahill told clients this week.

The capital flight argument should be especially worrying for U.S. savers and retirees nursing expensively priced investments, pumped up for years with overseas money drawn in by the U.S. "exceptionalism" theme.

Those worries often, understandably, home in on China, not least due to its $760 billion of Treasury holdings, which could potentially be weaponized if the trade war escalation continues.

But much of the additional foreign money that flooded into America's megacap stocks and relatively high-yielding bonds over the past decade was mostly from Europe.

And scared money tends to go home.

BUNKER BUNDS

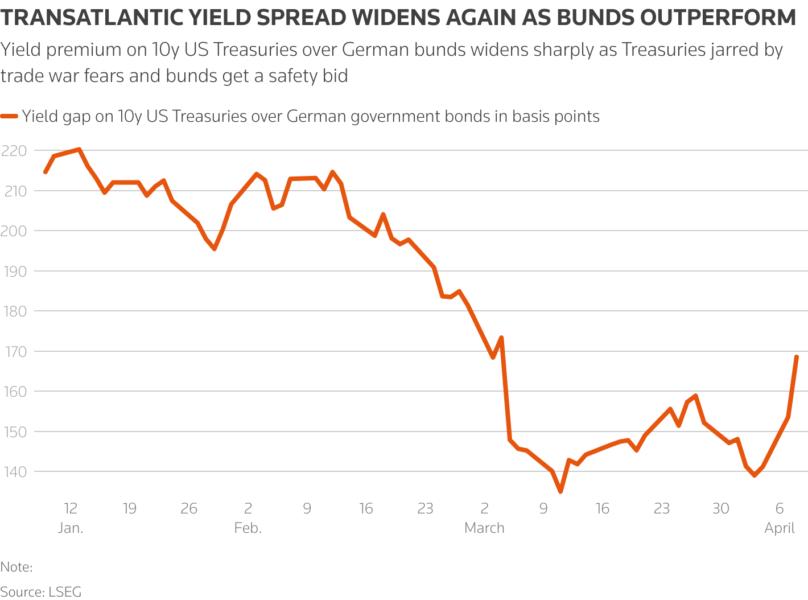

As U.S. Treasuries sold off violently this week, Europe's traditional safe haven - Germany's government bunds - rallied sharply. So much so that the yield premium of U.S. versus German 10-year debt (DE10US10=RR) surged 30 basis points this week to some 170 bps - the widest spread in a month.

Even though bunds (DE10YT=RR) were jarred in March by the new German government's trillion euro defence and infrastructure spending push, they have roared back since, despite an intensifying trade war that has major ramifications for euro area growth and European Central Bank policy.

But what has been truly notable this week is that bunds behaved like a safe haven when Treasuries didn't.

The extent to which this countervailing bund rally is driven by transatlantic repatriation is unknowable, but what can be safely assumed is that any returning European money won't necessarily go back to European equities, not yet at least.

So the bund market seems like the logical option. Indeed, there appear to be few doubts that the country is 'money good' even if its debt/GDP ratio is set to rise. Just look at the rock bottom German sovereign credit default swap pricing and the benign reactions of credit rating firms to the German fiscal stimulus.

"German Bunds offer better value as a safe haven with yields still elevated after the recent shift in fiscal policy," HSBC's global head of fixed income Steve Major told clients.

Major argues that if the ECB were to cut rates by more than forward markets now imply, bund yields have significant scope to fall across the curve and "are a good alternative safety play to US Treasuries".

While the modest size of the German bond market may mean it would have more difficulty absorbing a headlong dash for safety compared to the huge Treasury market, the supply of bunds is rising and there are higher yielding alternatives in the well supplied government debt markets of its euro zone partners.

Ultimately, the prospect of Germany, and Europe more generally, becoming a comfortable home for funds seeking safe assets has profound implications for the euro and dollar's respective roles in sovereign currency reserves.

The return to Europe has taken on many forms this year. But the retreat to its debt havens may be one of the more meaningful.

Chart of the day

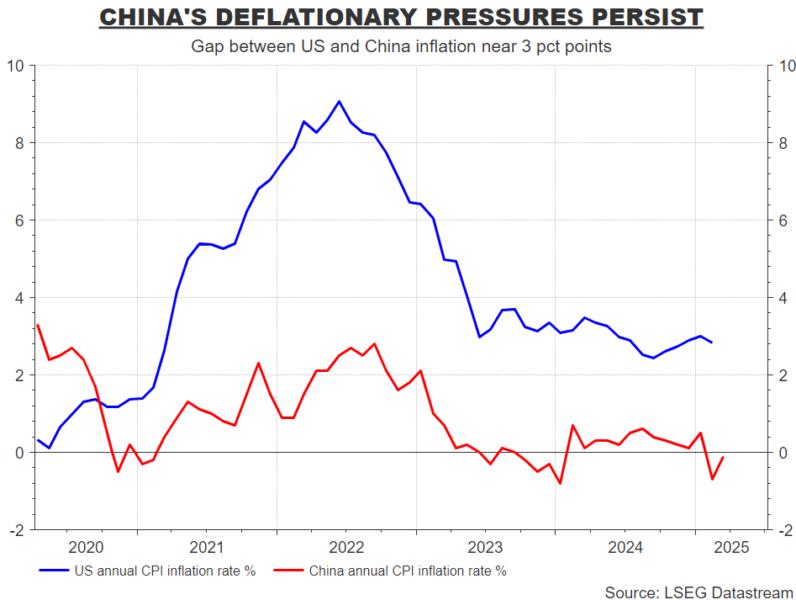

With the US-China trade war escalating despite the broader tariff pause, China's latest consumer price report shows the country was still in deflationary mode in March, in stark contrast to the still above-target U.S. CPI inflation.

Given the speed and scale of the tit-for-tat tariffs being levelled from each side, the growth and inflation fallout for both countries has become pure guesswork.

The March figures for U.S. inflation are due late on Thursday. U.S. CPI inflation is expected to have eased to 2.6% last month from 2.8% in February, but none of this will yet capture the potential impact of the ever-evolving tariff plans.

Today's events to watch

* U.S. March consumer price inflation, weekly jobless claims

* Kansas City Federal Reserve President Jeffrey Schmid, Boston Fed President Susan Collins, Philadelphia Fed President Patrick Harker, Dallas Fed boss Lorie Logan, Chicago Fed chief Austan Goolsbee and Richmond Fed chief Thomas Barkin all speak; Bank of England Deputy Governor Sarah Breeden speaks

* Senate Banking Committee holds hearing on nomination of Michelle Bowman to Federal Reserve vice chair for supervision

* Spanish Prime Minister Pedro Sanchez will visit China

* US corporate earnings: Carmax

* US Treasury sells $22 billion of 30-year bonds

Comments